Why the Bitcoin Security Model Is Broken

Bitcoin's security model is fundamentally flawed and unsustainable. It relies on an impossible exponential price increase to maintain its current level of security. Eventually, there will be a choice between a blocksize increase as per Satoshi’s original design, levying huge fees or allowing the network to become insecure.

So let's take a look at the inherent flaws in Bitcoin's security model and the possible paths forward.

Understanding Bitcoin's Security Model

Ok, let’s start with the basics. Those of you who already know all of this, bear with me … I will get to the point.

Before we dive in:

I write regularly and cover everything crypto, tech, and some of my musings.

With social media buzzing with crypto, this helps me keep my thoughts in one place.

Interested? Head over to my Substack and join the conversation:

What is Proof of Work (PoW)?

Proof of Work (PoW) is the cornerstone of Bitcoin's security. It was introduced by Satoshi Nakamoto in the original Bitcoin whitepaper.

The primary purpose of PoW is to prevent Sybil attacks, where a single entity could create multiple fake identities to gain control over the network.

In the context of Bitcoin, PoW ensures that the majority of computational power is controlled by honest nodes, making it infeasible for attackers to alter transaction history or double-spend coins.

The secondary purpose is to provide a deterministic mechanism so all parties in the network can determine which is the next block, and which sequence of competing blocks the network should align with.

In PoW, miners compete to solve a cryptographic puzzle, which involves slightly changing the block's data (a nonce value) with repeated attempts until a block hash is discovered below a certain target. This target is adjusted periodically to maintain a consistent block creation time, roughly every ten minutes. The difficulty of finding solutions for this puzzle ensures that it requires substantial computational effort, making it costly for any single entity to dominate the mining process.

To compensate miners for the expenditure of mining, Bitcoin includes an incentive structure. Miners are rewarded with newly minted bitcoins and transaction fees for each block they successfully mine which is accepted by the network as the next block. This reward system aligns the interests of miners with the security of the network, as they are financially motivated to act honestly and maintain the integrity of the blockchain.

Role of Miners in Securing the Network

The primary responsibilities of miners include validating transactions, adding new blocks to the blockchain, and maintaining the overall health of the network.

When a user initiates a Bitcoin transaction, it is broadcast to the network and enters a pool of unconfirmed transactions called the mempool. Miners select transactions from this pool for validation.

After validating transactions, miners group them into a block and start solving the PoW puzzle for that block. This ensures only legitimate transactions are added to the blockchain, preventing fraud and double-spending. If a miner was to include illegal transactions, the block would not be accepted by anyone else, no matter how strong the PoW.

Miners then compete to solve the PoW puzzle. The first miner to find a valid solution broadcasts the new block to the network.

Other miners and nodes verify the block's validity by checking the solution and the included transactions. If valid, the block is added to the blockchain, and the miner receives the block reward.

This continuous process of block creation and chain extension forms a chain of blocks, hence the name blockchain.

The longer the chain, the more secure it becomes, as altering any block would require re-mining all subsequent blocks, which is computationally prohibitive.

Difficulty Adjustment and Hash Rate

The hashrate is a measure of the computational power used in Bitcoin mining.

It represents the total computational power used by miners to process transactions and secure the network.

Specifically, hashrate measures the number of hash computations that miners perform per second in their attempt to solve the cryptographic puzzles required to add new blocks to the blockchain.

Bitcoin's PoW system dynamically adjusts the mining difficulty every 2016 blocks (approximately 2 weeks) to maintain an average block time of 10 minutes.

This difficulty adjustment mechanism serves two crucial functions:

It ensures a relatively stable issuance of new bitcoins over time.

It adapts the network's security in response to changes in total mining power (hash rate).

As the price of Bitcoin increases, more miners are incentivized to join the network, increasing the overall hash rate. The difficulty adjustment then increases, making it harder to mine blocks and maintaining the 10-minute average block time.

This mechanism creates a feedback loop where higher Bitcoin prices lead to increased network security.

It is important to note that the inverse happens if the value of Bitcoin decreases. Miners are essentially incentivized to leave, as there are not enough rewards to cover all miners operating expenses.

In a 51% attack, an attacker with more than half of the network's total hash rate could potentially reverse transactions and double-spend coins. However, this is not that easy as Satoshi has designed a clever economic security model that prevents such attacks on the Bitcoin network.

So let’s take a look at Bitcoin’s economic security model.

Economic Security Model of PoW: Mining Rewards and Security Budget

At the core of Bitcoin's security model is the concept of a "security budget" - the total value of rewards available to miners for securing the network.

This budget comprises two main components:

Block rewards: Newly minted bitcoins awarded to miners for successfully mining a block.

Transaction fees: Fees paid by users to have their transactions included in blocks.

Currently, block rewards constitute the majority of miner income.

Every 210,000 blocks (approximately 4 years), the block reward halves in an event known as "the halving."

This reduction in new bitcoin issuance is designed to create scarcity and assist with value appreciation of existing bitcoins.

The security budget directly impacts the resources miners are willing to invest in securing the network.

As the block reward decreases over time, the security of the network becomes increasingly dependent on transaction fees to incentivize miners.

Sathoshi envisioned a system where transaction fees would eventually replace block rewards as the primary source of miner compensation and network security funding. This transition was designed to occur gradually over time as the predetermined block reward schedule reduced the number of new bitcoins minted with each block.

In the Bitcoin whitepaper, Satoshi outlined this concept:

As the block reward diminishes through halvings, the network was expected to naturally shift towards a fee-based security model.

But there is a big issue facing this elegant solution which Satoshi devised:

As described above, the security budget consists of block rewards and transaction fees. The block rewards decrease with every Bitcoin halvening event, and the transaction fees have to compensate for the decreasing block rewards/block subsidy.

In order for the security budget to remain healthy during this transition, more transaction fees need to be collected, which in turn requires more Bitcoin transactions to be made.

Unfortunately some “smart minds” decided that the temporary block size limit Satoshi implemented to protect the network from spam when it was young should stay indefinitely,

This also can’t be fixed by allowing ever increasing fees, as there is a threshold by which the users of the network will consider the fees excessive and they will move to another network. The quantity of transactions reduces, decreasing fee revenue and potentially requiring the remaining transactions to make up for the fee deficit.

This forces a hard cap on the number of transactions Bitcoin can process during any given time period. Therefore placing a hard cap on fee revenue!

You might think, "Oh, that’s not a problem," because Bitcoin price is increasing exponentially every cycle, so the price increase will keep the security budget at a secure level, even if the block rewards are decreasing.

So this is where I would like to break this illusion of a "perpetual exponential price" increase and explain why it's not sustainable.

Why Bitcoin's Price Can't Keep Rising Exponentially Forever

From its inception in 2009, when it was virtually worthless, to its meteoric rise to over $70,000 in 2024, Bitcoin has captured the imagination of investors and the public alike.

So here’s a conservative estimation of how the Bitcoin price would develop if it just doubles every cycle.

These numbers might seem exciting to Bitcoin enthusiasts.

But there are some problems associated with the expectation of continued exponential growth.

Market Capitalization Constraints

One of the fundamental reasons why Bitcoin's price cannot keep rising exponentially is the constraint imposed by market capitalization.

Market capitalization is the total value of all Bitcoin in circulation, calculated by multiplying the price per Bitcoin by the total number of Bitcoins.

If Bitcoin's price were to reach $4,480,000 by 2048, as suggested by a hypothetical model where the price doubles every four years, the market cap would be approximately $94 trillion.

This figure is astronomical, exceeding the current market capitalization of all the gold in the world (around $15 trillion) and approaching the total global GDP (around $100 trillion as of 2024).

For Bitcoin to reach the projected values, it would need to capture a significant portion of global wealth. This scenario is unlikely given the diverse nature of the global economy and the existence of other stores of value and investment opportunities. Traditional assets like stocks, bonds, real estate, and commodities will continue to attract investment, making it improbable for Bitcoin to monopolize global wealth.

As Bitcoin's market cap grows, maintaining the same percentage growth rates also becomes increasingly difficult.

For instance, moving from a $1 billion to a $2 billion market cap is relatively easier compared to moving from a $1 trillion to a $2 trillion market cap.

Such a market cap would require an unprecedented amount of capital inflow, we are talking about 10s of trillions of capital inflow happening every year to maintain this growth rate.

This phenomenon of diminishing returns means that as Bitcoin becomes more valuable, its growth rate will naturally slow down, making exponential growth unsustainable in the long term.

This “forever exponential growth assumption” also ignores the way the global economy works too.

The idea that Bitcoin's price could continue doubling every four years indefinitely ignores global economic realities. The global economy experiences peaks and troughs, recessions, and other fluctuations. It's unrealistic to expect that the global economy, and by extension the Bitcoin economy, can sustain such exponential growth over the long term

As the cryptocurrency market matures, it's likely that Bitcoin's growth rate will slow down. The current bull run is already showing signs of being different from previous ones, with Bitcoin struggling to achieve the same multiples of growth as in past cycles.

This suggests that the market is maturing and that the days of easy exponential growth may be coming to an end.

So it’s absurd to believe that Bitcoin will increase in value over time and maintain its security budget.

At some point, the exponential growth of Bitcoin will slow down and may reach growth rates similar to equity markets or real estate markets. At that point, you will have moderate value growth for Bitcoin, and at the same time, block rewards, which contribute to 98-99% of the security budget, will drop by approximately 50% every 4 years.

So at some point, the security budget will reduce in relation to the total market cap of Bitcoin, and that’s when Bitcoin will be vulnerable to attack.

So let me elaborate on that.

The Inevitable Decline of Bitcoin’s Security Budget

Independent of what scenario you think will be coming—whether it's the optimistic scenario where Bitcoin's price doubles, the realistic scenario where it grows slowly, or the pessimistic scenario where it stays the same—the security budget as a percentage of the total market cap will decrease unless transaction fees cover a larger share of the security budget.

This happens because block rewards halve every cycle, and neither the value of Bitcoin nor transaction fees can increase exponentially to make up for that loss.

With a block size of 1MB, Bitcoin can only process a limited number of transactions at a time.

As a result, the market cap grows faster than the security budget, making potential attacks relatively cheaper over time. Historically, approximately 3% of Bitcoin's market cap has been sufficient to acquire 51% of the network's hash power.

If this security budget decreases relative to the overall market cap of Bitcoin, it will have serious consequences.

Potential Long-Range Attacks

So let's break down an example based on hypothetical scenario:

According to this calculation, the total security budget of Bitcoin for the whole year would be around 24 billion USD, which is approximately 1.7 percent of the total market cap of Bitcoin at a price of 70,000 USD per BTC.

Imagine a well-funded attacker who purchases $2.4 billion worth of Bitcoin today, representing only 10% of the network security budget.

While this Bitcoin can't be immediately used to fund mining activities for an attack, the attacker plays the long game.

Over the course of several halving cycles the value of the attacker's Bitcoin holdings could increase significantly with each cycle, assuming conservative market growth. Meanwhile, the network's security budget might remain relatively stable due to the reduction in block rewards.

After five cycles, or approximately 20 years, the attacker's initial $2.4 billion investment could theoretically grow to tens or even hundreds of billions of dollars.

As block rewards diminish over time, there's a possibility that the overall hash power securing the network might plateau or even decrease if there isn't sufficient economic incentive for miners to continue operations at the same scale.

And no, before you think it, improvements in mining hardware efficiency do not help here. As new mining hardware is developed, there is a potential short term gain for the miners which purchase it first. All other miners either have to also upgrade to remain competitive, or cease their mining operations as their previous generation of hardware is not sufficient to keep up. “A rising tide lifts all boats” so to speak.

Finally, we have to consider bear markets. Regardless of the previous all time high, during the market cycle the value of each Bitcoin will reduce. This forces some miners to pause their operations because it is not profitable with the reduced value to cover operating expenses. Hash power consumed by the network then drops until profitability is resumed.

This could create a perfect storm where executing a 51% attack becomes significantly more feasible and cost-effective for the long-term adversary.

Potential Decline of Hashrate

Another factor that contributes to the decreasing security ratio is the potential long term decline in hash rate.

If mining becomes less profitable due to reduced rewards, some miners may shut down operations, potentially leading to a decline in overall hash rate and network security. This could make the network more vulnerable to attacks, as less computational power would be required to control a majority of the hash rate.

In other words, if the hash rate declines, an attacker would need to spend less money to acquire the necessary computational power to launch a successful attack.

So if the current state of Bitcoin persists, these events are inevitably going to happen. The current way Bitcoin's security model works is fundamentally broken.

A secondary, and also disturbing issue to consider, is that of the centralization of mining and possible censorship. Miners are also responsible for selecting which transactions are in a block. If the quantity of miners is small, certain transactions could be excluded from blocks for a period of time. In the extreme case, there might become a “cabal” of miners, which all agree between them what types of transactions are accepted. For example, a very large Bitcoin transfer to an exchange signals a potential sell event. If this transaction was censored or excluded for a period of time, that potential sale event can be profitably front ran.

I digress, the real question is: Is there a way to keep the security budget proportional to the growth of the market cap of Bitcoin, ensuring that Bitcoin's security budget will always be at least 1% of its market cap in the long term?

There is Only One Realistic Solution For This

IMO the only solution to address the security budget problem is to gradually increase the block size.

Larger blocks would allow more transactions to be included in each block, effectively increasing the network's throughput.

And this might not come as a surprise, because this is how Satoshi envisioned Bitcoin would scale over time.

Here's how it would work:

Currently, Bitcoin has a fixed maximum block size of 1 MB, which limits the number of transactions that can be processed per block. If this limit were to be raised incrementally, let's say to 2 MB, 4 MB, and eventually 8 MB, each block could accommodate twice, four times, or eight times as many transactions as before.

Now, you might be thinking, 'Wouldn't that mean each individual transaction fee would decrease?'

And you'd be correct.

However, the key point is that with more transactions per block, the total sum of all those fees will be higher than what we have now with the 1 MB limit due to the competitive fee market, but still cheaper for the end user than it would be with a remaining 1MB limit.

By gradually increasing the block size over a span of years, it allows the network to adapt and provides time for the ecosystem to make necessary adjustments.

Now, the block size increase has been proposed by many before. The Bitcoin network forked into Bitcoin and Bitcoin Cash because of this issue.

The main argument was that if you increase the size of Bitcoin blocks, it would negatively impact decentralization.

But if you take a closer look, that argument was not intellectually honest.

Increasing Blocksize Does Not Compromise Decentralization

“If you increase the size of Bitcoin blocks, it would negatively impact decentralization.”

This was the motto of the faction that argued against increasing blocksize.

The reasoning behind this argument was that larger blocks would require more storage space, bandwidth, and computational resources to process and store the blockchain. This increased resource requirement, it was claimed, would lead to fewer people being able to afford or manage running a full node, potentially centralizing the network around a smaller number of well-resourced entities.

However, full nodes have always been operated altruistically, without direct rewards. The primary incentive for the individuals who own Bitcoin and choose to operate full nodes is to ensure that transactions they make or receive are verified and secure.

Above all, running a full node is relatively inexpensive compared to the costs associated with mining, typically just a few dollars a month. Whereas mining, especially at scale, requires significant investment in logistics, maintenance, hardware and electricity. This disparity isn’t going to change much even with a gradual increase in blocksize.

Even with larger blocks, pruned nodes offer a solution for individual users. With pruned nodes, individuals can still help the network without having to store the entire blockchain. They can store just the recent transactions and all the block headers, which is much less data.

Businesses that need the full blockchain history will likely run archive nodes. They have a business need for it, therefore a financial incentive to do so, which ensures that the data is available.

Moreover, the number of full nodes isn't directly related to the network's security. What matters most is the distribution of mining power and the economic incentives.

Therefore, the real reason why the block size was not increased is not because there was no path to maintain decentralization. Instead, it has more to do with the dynamics of power structures, oligarchy profitability and who controls Bitcoin.

The Politics Behind Bitcoin's Blocksize Stalemate

The current Bitcoin power structure is a significant obstacle to implementing a blocksize increase.

To understand why, it's essential to look at how Bitcoin's governance model works.

@justinbons recently wrote a great thread that explains the whole situation.

So let me summarize it for you.

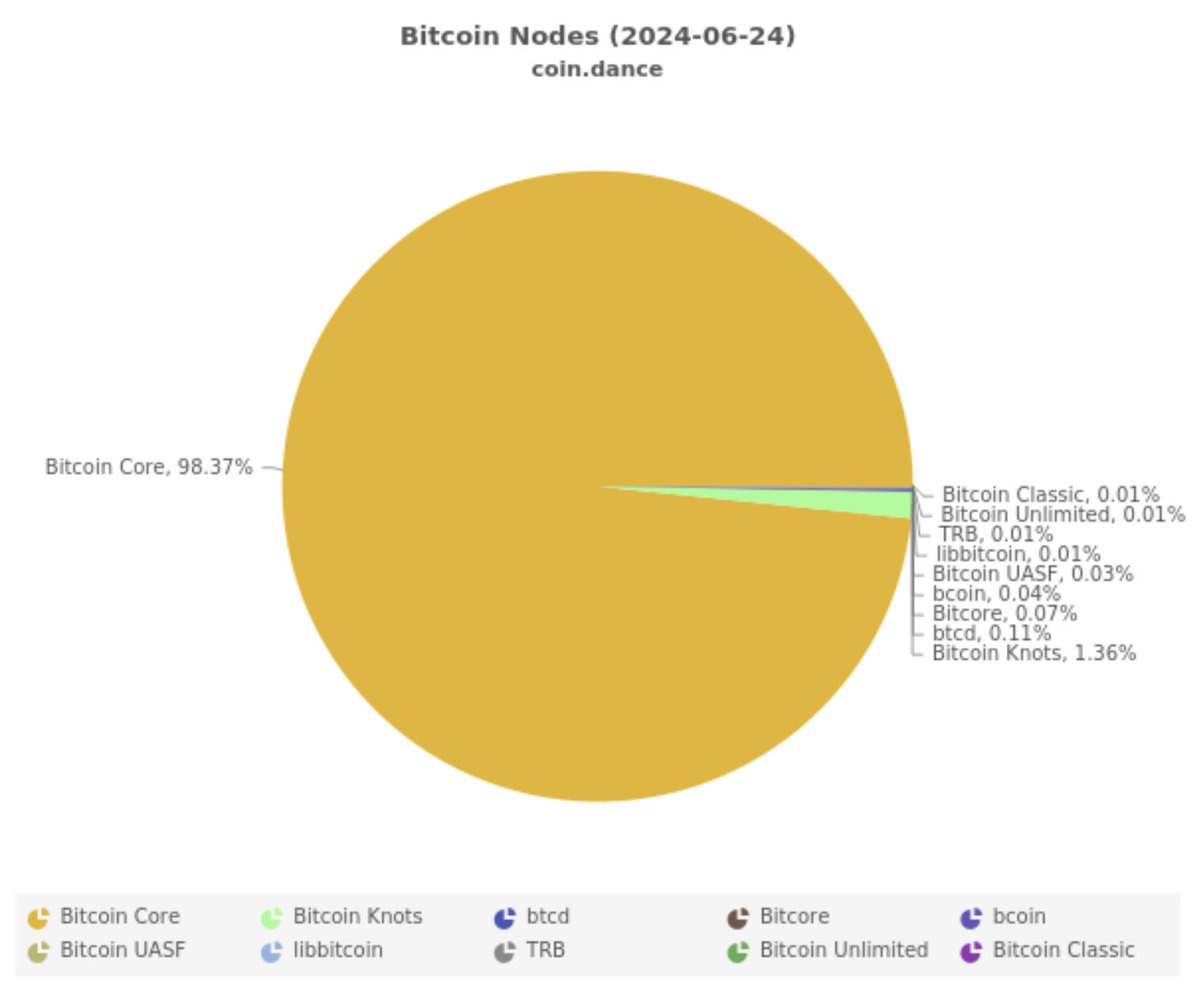

Bitcoin's governance is centered around the Bitcoin Core software, which is the dominant client implementation. Currently, more than 98% of full nodes run Bitcoin Core, giving the Core developers a significant amount of control over the network.

This concentration of power creates a single point of decision-making, which can hinder the implementation of changes that are not aligned with the Core developers' vision.

This is evident in the way that the blocksize debate was handled.

Despite the fact that many developers and users advocated for a blocksize increase, the Core developers were able to resist these changes and maintain the status quo.

This creates a conflict of interest, where the interests of the Core developers may not align with the interests of the broader Bitcoin community.

In the context of a blocksize increase, this means that even if a majority of users and developers support the change, it is not possible to implement that without the approval of the Core developers.

Final Thoughts

Ultimately, the Bitcoin security model, in its current form, is broken.

It is not designed to accommodate the network's security indefinitely and forever.

Without change, the network faces a future where its security diminishes relative to its value, making it an increasingly attractive target for attacks and even more centralization of mining power.

Whether it's revisiting the block size debate, exploring new fee structures, or implementing other viable approaches, action is needed to ensure Bitcoin's long-term security and viability.

As someone who has worked in this space for more than a decade, my motivation for writing this article stems from a deep concern for the direction Bitcoin is currently taking and a desire to spark meaningful discussion within the Bitcoin community.

Thanks for reading!

I'm write often on all things crypto, tech, and my occasional random thoughts.

Social media can be overwhelming, so this is my way to stay organized.

If you're keen, follow my Substack and don't miss a thing:

Excellent work, Dan.